Cash-Out Refinance vs. 2nd Mortgage

When does a Cash Out Refinance, HELOC, or fixed rate 2nd (HELoan) make the most sense?

If you’re a homeowner considering tapping into your home’s equity, you might be weighing a cash-out refinance versus a second mortgage or HELOC. Both options can give you access to funds, but the best choice depends on your financial situation, current mortgage, and goals. Here’s a guide to help you make an informed decision.

1. What is a Cash-Out Refinance?

A cash-out refinance replaces your existing mortgage with a new, larger loan. You get the difference between your new loan and your current loan balance in cash. Whether the cash would go towards a renovation project, paying off debt, or treating yourself or your family to something special it would be up to you.

Pros:

Often lower interest rates than a second mortgage or HELOC because it replaces your first mortgage.

Simplifies payments into one loan.

Cons:

Extends the life of your loan unless you keep the same term. For example you could get a new loan with a 27 year loan term if you wanted.

Closing costs apply, similar to a traditional refinance.

Depending on where the interest rate market is, replacing your first mortgage with a new mortgage might be at a higher rate. This doesn’t necessarily mean it’s the wrong option, just something to weigh versus the alternatives.

Example:

Current mortgage: $300,000 at 5%

Home value: $450,000

Cash-out refinance for $350,000

Cash received: $50,000 ($350k – $300k)

New interest rate: 5.25% (slightly higher due to cash-out and where the market is)

2. What are the options for a Second Mortgage?

Option A)

A Home Equity Line of Credit (HELOC) is a separate loan that sits behind your first mortgage. You can think of it as a kind of credit card that is secured by the equity in your home. While HELOCs come in all shapes and sizes, often, you can borrow, pay back, and borrow again during your draw period (usually 5-10 years). After the draw period, you enter the repayment period where you cant borrow any more, and must pay off the balance, often over the 10-20 year period of the loan.

Pros:

Keep your first mortgage rate, especially if it’s low. Often, the first mortgage has a much larger balance than the 2nd that you might need.

Flexible repayment if you choose a HELOCdraw when needed).

Cons:

Rates are usually higher than a first mortgage. Generally, HELOCs have a variable interest rate, so payments can change over time.

Two monthly payments to manage.

Can complicate your debt-to-income ratio if you borrow too much.

Example:

First mortgage: $500,000 at 5%

Home value: $650,000

HELOC: $75,000 at 8.5%

Total monthly payments may be higher than rolling into a cash-out refinance.

Option B)

A fixed rate second mortgage, otherwise known as a Home Equity Loan or HELoan. With a fixed rate 2nd, you borrow a lump sum based on your home’s equity. It has a fixed interest rate, making your monthly payments predictable. These loans are typically repaid over 5-30 years.

Pros:

Good for big expenses like home renovations, debt consolidation, and other major expenses.

Can have long repayment terms

A predictable way - fixed monthly payments - to unlock your home’s equity

Cons:

Higher Interest Rates than a first mortgage.

Generally higher closing costs or fees as there often needs to be an appraisal.

Key difference between a HELOC and a HELoan:

HELoan: lump sum, fixed interest, fixed payments

HELOC: revolving credit, variable interest, flexible payments

3. Blended Rate Considerations & A Scenario to See the Math Needed to Effectively Compare

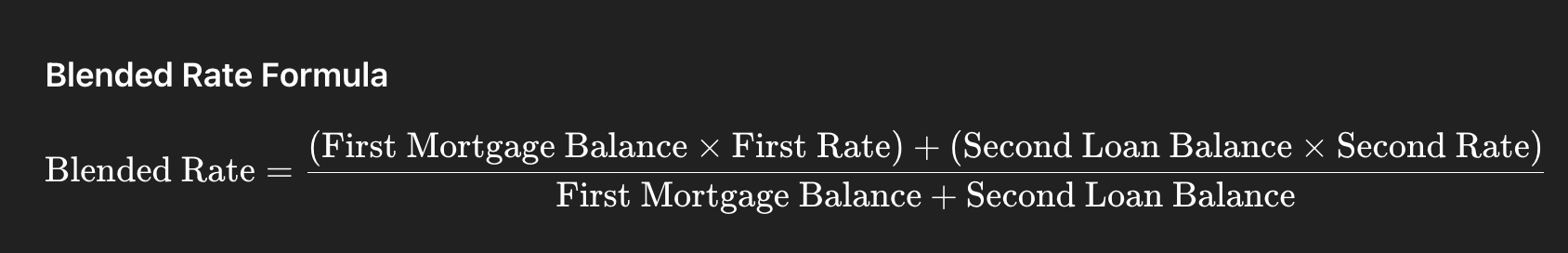

If you take a second mortgage or HELOC, your blended rate is the effective interest rate across both loans. This matters because:

Scenario

Home value: $900,000

Existing first mortgage: $700,000 at 5% (30-year fixed)

Desired cash-out: $100,000 for remodel/debt consolidation

Option 1: Cash-Out Refinance

New first mortgage: $800,000 (old balance + cash out)

Rate: 6% (slightly higher than existing first)

Term: 30 years

Monthly payment (P&I): $4,796

Pros: single payment, simple

Cons: higher rate on entire balance, resets term

Option 2: Second Mortgage / Home Equity Loan

First mortgage: $700,000 at 5% (existing, unchanged)

Second mortgage: $100,000 at 8%, 10-year term

Monthly payments:

First mortgage: $700,000 × 5% → $3,760

Second mortgage: $100,000 × 8%, 10-year → $1,213

Total blended monthly: $3,760 + $1,213 = $4,973

Blended rate (weighted by balance): 5.375%

Pros: keep original first mortgage rate, no reset of term

Cons: higher monthly due to short term on second

Option 3: HELOC

First mortgage: $700,000 at 5%

HELOC: $100,000 variable, 8% interest only (initial 10 years)

Monthly payment (interest only):

First mortgage: $3,760

HELOC: $100,000 × 8% ÷ 12 ≈ $667

Total: $4,427 (lower monthly, variable rate risk after 10 years)

Pros: lower initial monthly, flexible draws

Cons: variable rate, can increase, interest-only doesn’t build equity

Bottom Line

Choosing between a cash-out refinance and a second mortgage comes down to your current interest rate, how much cash you need, and your long-term plan. Run the numbers: compare monthly payments, blended rates, closing costs, and flexibility.

If you’re not sure which is right for you, a mortgage professional can help model different scenarios so you see exactly what each option costs and saves.

Curious which option fits your situation? Get a customized quote today and see your numbers side-by-side.